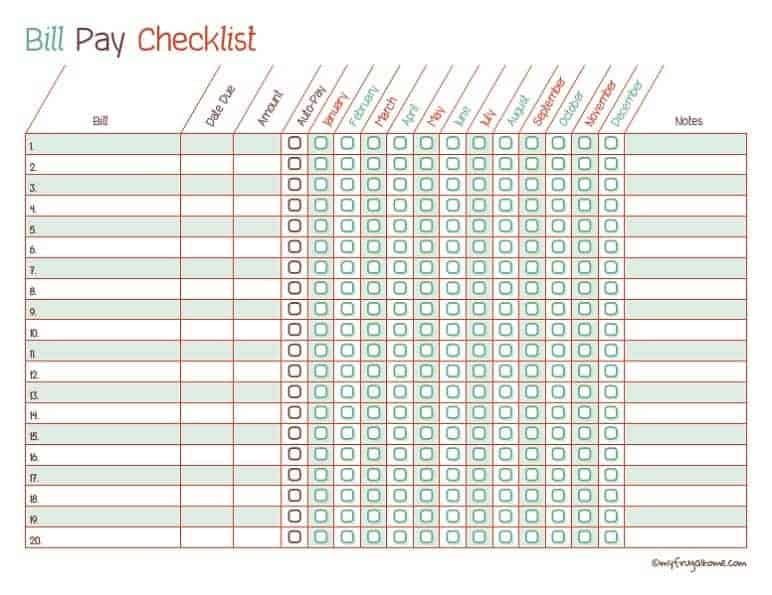

Use this printable bill pay checklist to check off your bills as you pay them each month. It’s an easy way to catch oversights before they result in late fees and added interest.

The form is fully editable, so you can customize it with all of your bill pay information before you hit print.

Staying on top of your monthly bills can feel like a full-time job. Between due dates late fees, and keeping track of what you’ve paid, it’s easy to let something slip through the cracks. But with my free printable bill pay checklist, you can get organized and simplify bill paying – without the headaches.

As the founder of My Frugal Home, I’m passionate about helping families take control of their finances. This checklist has been one of my most popular free printables for years, because it’s an easy system that works. I’ll walk you through how to use it, so you can stop worrying and start feeling confident that all your bills are handled each month.

Why You Need a Bill Pay Checklist

Life gets busy – it’s easy to forget a bill payment or two during hectic times. Before you know it, you’re hit with late fees, interest charges, and dings to your credit. A simple checklist solves these problems by:

-

Keeping all your bills in one place – No more hunting through a disorganized pile of papers trying to figure out what needs to be paid. At a glance, you’ll see what’s due and when.

-

Avoiding late payments – Check off each bill as you pay it, and you’ll never accidentally overlook one. No more surprise late notices in the mail.

-

Tracking payment confirmations – Write down reference numbers and payment dates right on the checklist, so you have a record. No more trying to dig up proof that you paid a bill.

-

Planning your monthly budget – With all your fixed expenses laid out in black and white, it’s easy to calculate how much is needed each month. No more guessing at figures.

Simply put, it provides stress-free organization. Read on for how to take advantage of this free tool.

How to Use the My Frugal Home Bill Pay Checklist

My printable bill pay checklist couldn’t be easier to use Just follow these simple steps

1. Download and Customize

Visit the My Frugal Home website and download the PDF file. Open it using Adobe Reader.

You can now customize the form by typing your personal bill information into the blank fields. Enter the payment amount and due date for each bill.

2. Print and Hang Up

Print out your filled-in checklist. I like to hang mine on the wall or refrigerator for easy access. But you can also place it in a binder or keep a digital copy on your phone or tablet.

3. Check Off Bills as You Pay

As you pay each bill every month, simply check it off on the form. For peace of mind, you can write in confirmation numbers and payment dates.

4. Review and File

After paying all your bills for the month, give the checklist a quick review to make sure nothing was missed. File the checklist away for future reference.

Then, print out a fresh copy for next month! Having a new checklist each month helps ensure you don’t lose track of any bills.

Extra Bill Pay Tips

To make bill paying even more of a breeze, keep these additional pointers in mind:

-

Schedule bill payments for paydays or when you know funds will be available to avoid overdrafts.

-

Set up automatic payments for fixed expenses likes loans, utilities, insurance, etc. Remember to update the checklist amounts to reflect auto-pay discounts.

-

Log in to online accounts frequently to check for any billing notices or changes to due dates. Update your checklist accordingly.

-

If a bill amount fluctuates, leave the amount column blank and pencil in the actual amount each month.

-

Consider having household bills like cable and electricity in one partner’s name, and bills like auto loans and insurance in the other partner’s name. This can simplify bill tracking.

-

Whenever possible, choose a single due date for all bills, like the 1st or 15th of the month. This consolidates payments to one time period.

Enjoy Peace of Mind with a Bill Pay Checklist

Staying organized can make a huge difference when it comes to successfully managing your personal finances. You’ll gain control over your bills, avoid late fees, and reduce stress. My free printable bill pay checklist takes all the hassle out of bill paying so you can gain peace of mind.

Prefer to Keep Things Digital?

Just save a copy of this file to your preferred device, and update it each time you pay a bill. Easy!

3 WAYS TO SAVE ON GROCERIES THAT NO ONE TALKS ABOUT!!! #shorts #budget

FAQ

What information do I need to use bill pay?

How do I keep track of paying bills?

Is there an app that I can pay all my bills?

How to make a bill list?